Introduction: Let’s Talk About Your Home Loan

Have you ever wished one of your monthly bills would just stay the same forever? No surprises. No sudden price jump. No worrying about changes.

Guess what? A fixed-rate mortgage does exactly that.

When you buy a home, you’re making a huge decision—emotionally and financially. It’s exciting, but it can also feel scary when you think about paying for something over the next 15, 20, or 30 years. That’s why so many people choose a fixed-rate mortgage: it gives you predictability, stability, and peace of mind.

In this friendly guide, we’ll walk through:

- What a fixed-rate mortgage actually is

- How it works (in simple terms!)

- How to get one

- Smart strategies for using it

- A real-life example

- And the questions most people ask

By the end, you’ll feel confident talking to lenders and making smart home decisions.

What Is a Fixed-Rate Mortgage?

Let’s keep this super simple.

A fixed-rate mortgage is a home loan where the interest rate stays exactly the same for the entire life of the loan.

Interest rate = the fee the bank charges you for borrowing money.

Here’s the magic:

Your payment never changes. Not in year 1. Not in year 20. Not in year 30.

A Simple Analogy

Imagine you agree to buy a pizza every month for 30 years, and the shop says:

“Okay, it’ll cost you $15 forever. We’ll never raise the price.”

Even if everyone else starts paying $22 for pizza one day, you still pay $15.

That’s a fixed-rate mortgage. You lock in your payment from the beginning.

Why It Matters for Homeowners

Predictability = Peace of Mind

When your payment stays the same:

- Budgeting becomes easy

- You never worry about sudden increases

- You can plan your finances with confidence

Over 90% of U.S. homeowners choose a fixed-rate mortgage, mostly because they love the stability.

Protection from Rising Rates

Interest rates change based on the economy. Sometimes they go way up.

But with a fixed-rate mortgage?

You’re protected. Rates could jump tomorrow, but your rate stays the same. It’s like an invisible financial shield.

Long-Term Stability

A stable payment lets you focus on:

- Saving

- Investing

- Life goals

- Family plans

Knowing your biggest monthly expense will never surprise you is incredibly comforting.

How Fixed-Rate Mortgages Really Work

When you borrow money to buy a house, the lender gives you the cash upfront. In return, you pay it back over time—usually 15, 20, or 30 years.

Understanding Your Interest Rate

Your interest rate is a percentage that tells you how much extra the bank charges you for the loan.

If you borrow $300,000 at 6%, that 6% stays the same every year until the loan is fully paid.

This is different from an adjustable-rate mortgage (ARM), where your rate (and payment!) can change over time.

Breaking Down the Monthly Payment

Your monthly home payment usually includes four parts, often called PITI:

➊ Principal – The actual amount you borrowed

➋ Interest – The bank’s fee for lending you money

➌ Taxes – Property taxes paid to your local government

➍ Insurance – Home insurance to protect your property

Visual Idea

Infographic: Pie chart showing 4 sections labeled Principal, Interest, Taxes, Insurance.

Alt Text: “Diagram showing the four parts of a typical mortgage payment: principal, interest, taxes, and insurance.”

Early in your loan, more of your payment goes toward interest. Over time, more goes toward principal—that’s just how loans work.

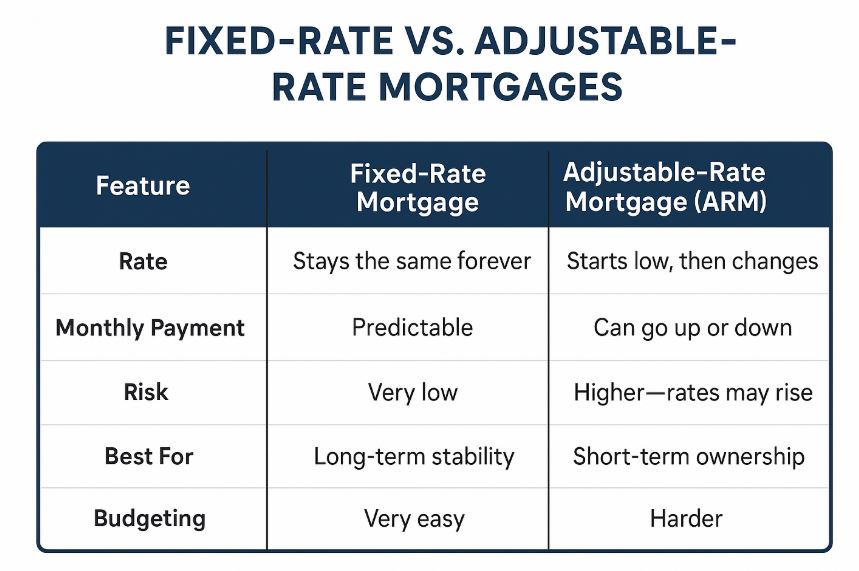

Fixed-Rate vs. Adjustable-Rate Mortgages

You’ll hear people talk about two major types of mortgages:

A Quick Analogy

A fixed-rate mortgage is like buying a dinner with a set price.

An ARM is like buying dinner where the price might change while you’re eating it. Yikes!

Step-by-Step Guide to Getting a Fixed-Rate Mortgage

Here’s the simple roadmap from start to finish.

Step 1: Check Your Credit Score

Your credit score is like your financial report card. Lenders use it to see how reliable you are with money.

You can check it for free at:

- AnnualCreditReport.com

- Credit Karma

A score of 620 or better usually gets you decent rates. A higher score = lower interest = lower monthly payment.

Step 2: Get Pre-Approved

A pre-approval is when a lender reviews your finances and tells you how much they can lend you.

They look at:

- Your income

- Your existing debt

- Your down payment

- Your credit score

You’ll get a pre-approval letter that says something like:

“We can lend you up to $350,000.”

Now you know your price range!

Step 3: Find a House and Complete Formal Approval

After you find “the one” and make an offer, the lender will double-check everything.

They’ll also order an appraisal, which is a professional estimate of the home’s value.

Approval usually takes 30–45 days.

Step 4: Lock In Your Interest Rate

This is huge. Rate lock means your interest rate is guaranteed for a set period (usually 45–60 days).

If you lock in at 6.5% today and rates rise to 7% next week, you still get 6.5%.

Rate lock = protection!

Step 5: Close on Your Home

Closing is paperwork day! You:

- Sign documents

- Pay your down payment

- Cover closing costs

- Get your keys

The whole process from offer to move-in usually takes 4–6 weeks.

Key Considerations for Successfully Using a Fixed-Rate Mortgage

Choose the Right Loan Term

30-year mortgage

- Lowest monthly payment

- Most common (over 70% of borrowers choose this)

- More interest paid over time

15-year mortgage

- Higher payment

- Pay off the house twice as fast

- Save tens of thousands in interest

20-year mortgage

A middle ground that balances both.

Ask yourself:

“Do I want the lowest payment, or do I want to pay the least total interest?”

Save for a Down Payment

Your down payment is the money you put upfront.

If the home costs $300,000:

- 20% down = $60,000

- 5% down = $15,000

A bigger down payment = lower monthly payment.

Most first-time buyers put down 6–7% on average—so don’t feel bad if 20% feels impossible.

Understand the Costs Beyond Your Payment

Homeownership includes:

- Property taxes

- Home insurance

- Maintenance

- Possible HOA fees

Plan ahead so these don’t surprise you.

Make Extra Payments When You Can

Even $50–$100 extra toward principal each month can:

- Save you thousands

- Shorten your loan by months or years

Small extra payments = big long-term savings.

Taking It to the Next Level: Refinancing and Smart Tips

What Is Refinancing?

Refinancing is when you replace your old mortgage with a new one—usually to get a lower rate.

You might refinance if:

- Rates drop

- You want a shorter loan term

- You want to lower your monthly payment

It costs money to refinance, so make sure the savings are worth it.

When Should You Lock Your Rate?

Trying to “time the market” perfectly is stressful. Rates change daily and even experts get it wrong.

A good rule:

If the rate looks good and you’re ready to buy, lock it.

A good rate now is better than the perfect rate later that never comes.

Use a Mortgage Calculator

Use the mortgage calculator on 101sols.com (internal link suggestion):

https://101sols.com/mortgage-calculator

This tool helps you instantly see:

- Your monthly payment

- How down payment affects your loan

- How loan term changes your total cost

Experiment with numbers—you’ll learn a lot!

Common Questions People Ask About Fixed-Rate Mortgages

Q: What if rates drop after I lock in my rate?

You can refinance later—but only if the savings are worth the cost.

Q: Can I pay off my mortgage early?

Yes! Most lenders allow extra principal payments anytime.

Q: What’s a “good” interest rate?

Rates change constantly. A good rate is one that’s competitive and fits your budget.

Q: Do I have to get a 30-year loan?

Nope. Choose 15, 20, 25, or 30 years based on your goals.

Q: What if I can’t make a payment?

Talk to your lender immediately. They often have hardship options.

Real-Life Example: How a Fixed-Rate Mortgage Works

Let’s look at a simple scenario.

The Situation

Sarah wants to buy a $300,000 home.

She has $60,000 saved (20% down).

She needs to borrow $240,000.

The Loan

She chooses a 30-year fixed-rate mortgage at 6%.

The Payment

Principal + interest = about $1,439 per month

Add taxes and insurance → around $1,700–$1,800 total.

The Stability

For 30 years, Sarah pays the same monthly payment.

No surprises. No rate jumps.

The Payoff

After 30 years, she owns the home outright.

She paid about $518,000 total ($240k loan + interest).

That may sound like a lot, but that’s the cost of borrowing a large amount over a long period—and she enjoyed three decades of predictable payments.

Wrapping Up: Why Fixed-Rate Mortgages Are Great for Most People

A fixed-rate mortgage gives you:

- Predictable monthly payments

- Protection from rising rates

- A stable financial foundation

- Long-term peace of mind

It’s one of the safest and most popular choices for homeowners—especially first-time buyers and people planning to stay in their home for many years.

Ask yourself:

- Do I want predictable, steady payments?

- Would knowing my exact monthly cost help my budget?

- Am I planning to stay in this home for a while?

If you said “yes,” a fixed-rate mortgage might be perfect for you.

Ready to take the next step?

Check your credit score, talk to a few lenders, get pre-approved, and start exploring homes.