Did you know that you might have to pay something called mortgage insurance when you buy a home? Many people don’t hear about it until they’re already deep in the home-buying process. And let’s be honest—finding out about a new cost at the last minute isn’t fun for anyone.

But here’s the good news: once you understand what mortgage insurance is and why it exists, the whole idea becomes way less scary. In fact, it can even help you buy a home sooner than you thought possible.

In this guide, we’ll walk through everything you need to know in simple, everyday language. We’ll cover:

- What mortgage insurance really is

- Why it matters for homeowners

- A step-by-step guide to how it works

- Tips to handle it with confidence

- Ways to reduce or even remove it

- A friendly wrap-up with my personal experience

Ready? Let’s dive in together. You’ve got this!

What Is Mortgage Insurance?

Mortgage insurance is a type of protection your lender requires when you buy a home with less than a 20% down payment.

The term might sound fancy, but here’s the simple version:

Mortgage insurance protects the lender, not you, in case you can’t make your mortgage payments.

Think of it like this:

Imagine your friend lets you borrow their favorite bike. If you’re only allowed to ride it without training wheels, they feel pretty safe. But if you insist on using training wheels, they may feel a bit unsure—and might ask you to wear extra protective gear first. Mortgage insurance is kind of like that protective gear.

Why It Matters for Homeowners

Even though mortgage insurance protects the lender, it actually helps you, too. Here’s how:

- You can buy a home with less money upfront.

- You don’t have to wait years to save a 20% down payment.

- It opens the door for first-time homebuyers who need a little help.

About 60% of first-time homebuyers put down less than 20%—so needing mortgage insurance is totally normal. Isn’t that reassuring?

Step-by-Step Guide to How Mortgage Insurance Works

So, how does mortgage insurance actually work in real life? Let’s break it down into simple steps.

Step 1: You Buy a Home With a Low Down Payment

Most lenders require a 20% down payment to avoid mortgage insurance.

If you put down less than that, the lender asks for PMI, which stands for Private Mortgage Insurance.

PMI = the most common type of mortgage insurance for regular home loans.

H3: Step 2: You Pay the Mortgage Insurance Monthly, Upfront, or Both

Your mortgage insurance payment can show up in a few ways:

- Monthly payments added to your mortgage bill

- One upfront payment at closing

- A mix of both

Many people choose the monthly option because it spreads out the cost.

Step 3: Your PMI Eventually Ends

Here’s the best part—PMI doesn’t stick around forever.

Once you reach 20% equity (the amount of your home you truly own), you can ask your lender to remove PMI.

Equity is just the home’s value minus what you owe.

It’s like paying down your phone or car—you slowly own more of it over time.

You can reach this 20% milestone by:

- Making your regular payments

- Paying extra toward your mortgage (if you can!)

- Your home value going up over time

Most PMI gets removed automatically at 22% equity, thanks to federal law. Nice, right?

Key Considerations for Successfully Understanding Mortgage Insurance

Before you jump into buying a home or refinancing, here are some key things to keep in mind:

➊ Mortgage insurance doesn’t protect you

It only protects the lender if you stop making payments.

But it does help you get into a home faster.

➋ Not all mortgage insurance is the same

Different loan types have different rules. For example:

- Conventional loans use PMI

- FHA loans use MIP (Mortgage Insurance Premium)

- USDA loans have a guarantee fee

- VA loans don’t require monthly insurance but charge a one-time funding fee

➌ FHA mortgage insurance lasts longer

If you use an FHA loan and put down less than 10%, your MIP may last for the life of the loan.

That’s one reason many people refinance out of FHA later.

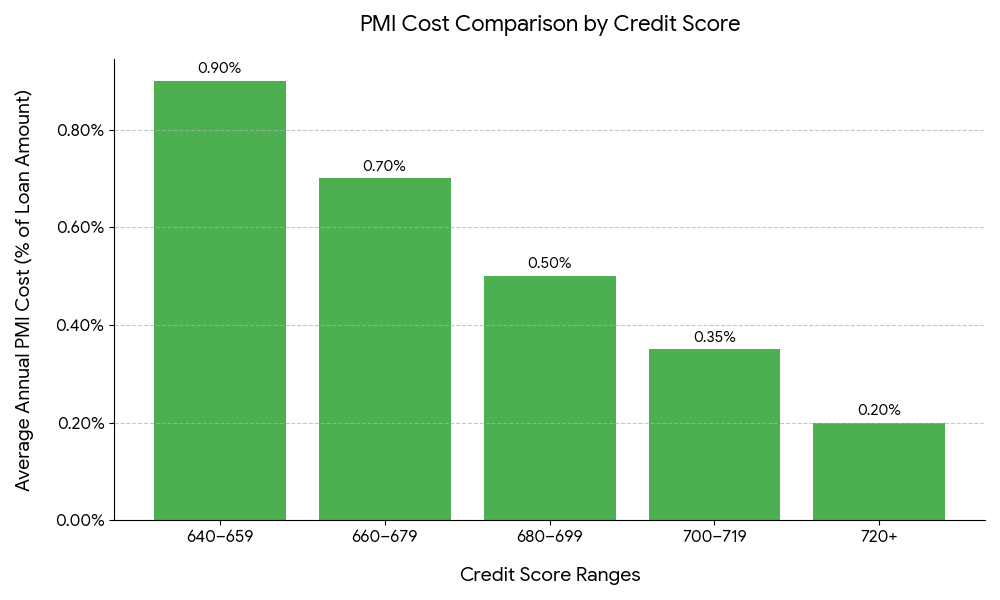

➍ Your credit score affects your PMI rate

Higher credit score = lower PMI cost.

Lower credit score = higher PMI cost.

This is similar to car insurance—safe drivers get better rates.

➎ Use a mortgage calculator

A calculator helps you see how PMI changes your mortgage payment.

You can try one on 101sols.com/mortgage-calculator (internal link suggestion).

Taking It to the Next Level: How to Lower or Remove Mortgage Insurance

You don’t have to accept mortgage insurance forever. Here are some easy ways to reduce or eliminate it sooner.

Alternatives or Tips

1. Put down 20% if you can

This is the simplest way to avoid PMI.

But if that’s not possible, don’t worry—most people don’t hit 20% on their first home.

2. Consider “lender-paid PMI”

This is where your lender pays your PMI but raises your interest rate slightly.

It can work if you want a lower monthly payment and don’t plan to stay in the home long-term.

3. Refinance your mortgage

If your home has gained value (and it likely has—home prices have risen about 6–7% per year recently), refinancing can do two things:

- Remove PMI

- Give you a better interest rate

Check out the refinancing guide at 101sols.com/refinancing-guide.

4. Make extra payments

Just one small extra payment each year can save thousands and help you reach 20% equity faster.

5. Ask your lender for PMI removal

Once you hit 20% equity, you can call your lender and ask.

It never hurts to try, and sometimes they’ll say yes earlier than expected.

Wrapping Up and My Experience with Mortgage Insurance

Mortgage insurance may not be exciting, but it’s one of those things that really helps people become homeowners. When I bought my first home, I didn’t have anywhere close to 20% saved. PMI felt like an annoying extra cost. But honestly? It allowed me to buy years earlier than expected.

A couple of years later, home values increased. I refinanced, and the PMI disappeared—just like that. It was a huge relief, and I wished I had understood the process sooner.

So don’t stress if you need mortgage insurance.

It doesn’t mean you’re doing anything wrong.

It’s just part of the journey most homeowners take.

Conclusion

Let’s do a quick recap:

- Mortgage insurance helps you buy a home with less than 20% down.

- It protects the lender, but it benefits you by lowering the barrier to owning a home.

- It can be paid monthly, upfront, or both.

- PMI usually goes away once you reach 20% equity.

- You can reduce or remove it through refinancing, extra payments, or rising home values.

Buying a home is a big step, but understanding mortgage insurance makes the path much clearer.

So what do you think—does mortgage insurance still feel confusing, or does it make a little more sense now?

You’ve totally got this!