If you’re thinking about buying a home or refinancing, asking “What are current mortgage rates?” is a smart move. Even a small change in interest can save or cost you tens of thousands of dollars over the life of a loan.

According to Freddie Mac’s Primary Mortgage Market Survey (January 2026):

- 30-year fixed-rate mortgage: ~6%

- 15-year fixed-rate mortgage: ~5.25–5.3%

- 30-year refinance mortgage: ~6.5%

Mortgage rates fluctuate based on market conditions, credit scores, down payments, and loan types.

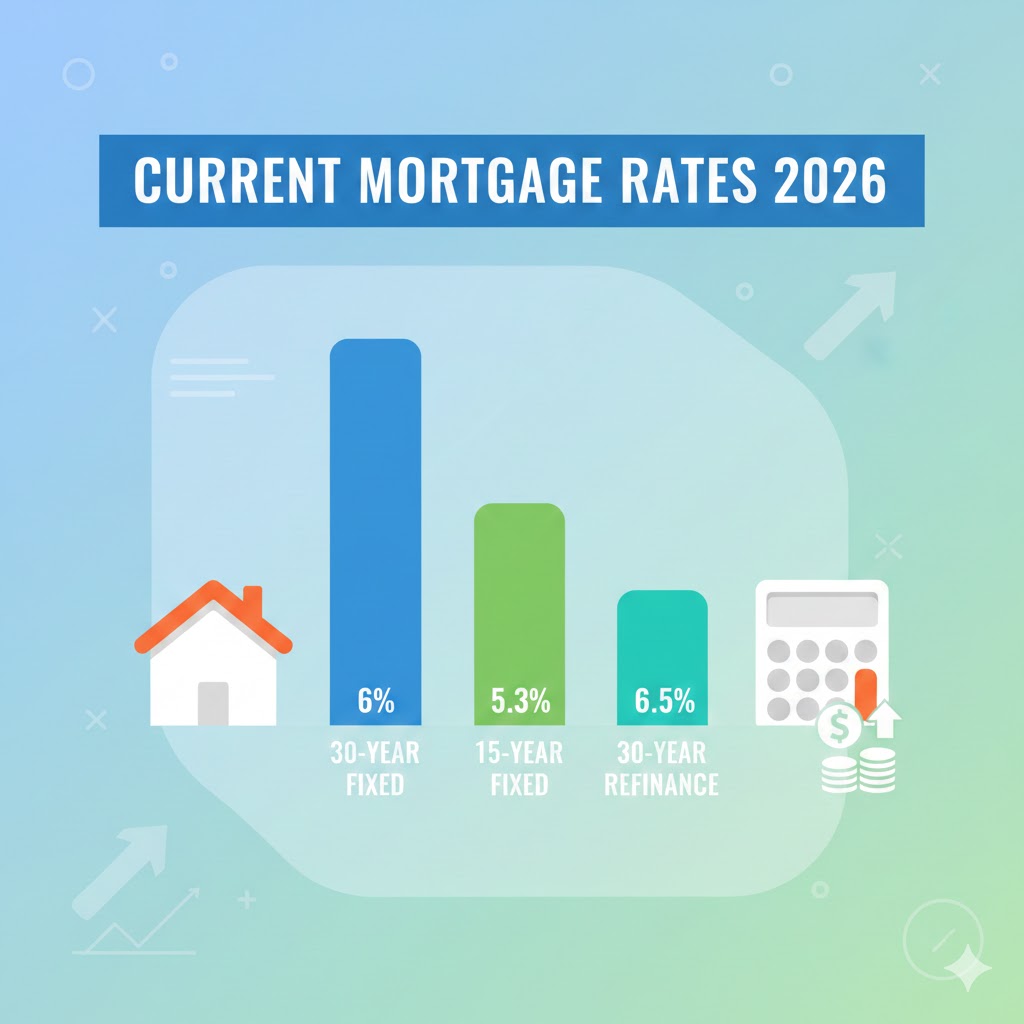

Visual idea: Bar chart comparing rates

- Bar 1: 30-year fixed = 6%

- Bar 2: 15-year fixed = 5.3%

- Bar 3: 30-year refinance = 6.5%

Alt text: “Bar chart showing average 30-year, 15-year, and refinance mortgage rates in January 2026.”

What Is a Mortgage?

A mortgage is a loan used to buy a home, with the property serving as collateral. Key components include:

- Principal: The amount you borrow.

- Interest: The cost of borrowing money.

Monthly mortgage payments usually cover:

- Principal

- Interest

- Property taxes

- Homeowners insurance

- Mortgage insurance (if down payment is small)

Why Mortgage Rates Matter

Understanding rates helps you:

- Control your monthly payment: Higher rates = higher monthly payments.

- Save money over time: A 1% difference in interest can cost tens of thousands over 30 years.

- Increase your buying power: Lower rates allow you to qualify for a larger loan.

For example, a $400,000 home at 6% over 30 years could cost roughly $36,000 more in interest than the same loan at 5%.

Fixed vs Adjustable: Which Loan Is Right?

- Fixed-rate mortgage: Rate stays the same for the loan term. Predictable payments.

- Adjustable-rate mortgage (ARM): Rate fixed initially, then can rise or fall with the market.

Visual idea: Flowchart

- Question: “Will you stay in the home 7+ years?”

- Yes → Fixed-rate mortgage

- No → ARM

Alt text: “Flowchart helping homebuyers choose between fixed-rate and adjustable-rate mortgages.”

Step-by-Step Guide to Using Today’s Rates

Step 1: Check Today’s Average Rates

Rates vary by lender and borrower profile. Use reputable sources like:

Step 2: Know What Affects Your Rate

- Credit score: Higher scores get lower rates.

- Down payment: More down = lower rate + no PMI.

- Loan type: FHA, VA, USDA may differ from conventional loans.

- Loan term: 15-year loans usually have lower rates than 30-year.

- Market conditions: Inflation, Fed rates, and economic indicators influence mortgage rates.

Step 3: Use a Mortgage Calculator

Input:

- Home price

- Down payment

- Interest rate

- Loan length

Output: Monthly payment estimate.

Visual idea: Pie chart showing a $2,400 monthly payment breakdown

- Principal = 55%

- Interest = 30%

- Taxes & Insurance = 15%

Alt text: “Pie chart showing how monthly mortgage payment is split between principal, interest, taxes, and insurance.”

Step 4: Compare Lenders

- Check at least 3 lenders: national bank, local credit union, online lender.

- Compare interest rate + APR (fees included).

- Look at the same loan type and length to get accurate comparisons.

Key Considerations for a Good Mortgage

- Know your budget – Use calculators to see what fits comfortably.

- Choose the right loan type – Fixed vs ARM depending on your plan.

- Think about loan length – 30-year = lower monthly, higher total interest; 15-year = higher monthly, lower total interest.

- Refinancing – Check if current rates are lower than your existing mortgage.

- First-time homebuyer tips – Explore FHA or local programs and online classes.

Advanced Tips to Save

- Improve your credit score before applying.

- Buy points to lower interest upfront if you plan to stay long-term.

- Shorten the term when refinancing to reduce total interest.

- Watch market trends for opportunities to refinance.

Internal links for readers:

Wrapping Up

Mortgage rates are just the cost of borrowing money. Learning how they work helps you:

- Save thousands over time

- Choose the right loan type

- Understand your monthly payment

Next Steps:

- Check today’s average rates on Freddie Mac or Bankrate.

- Use a mortgage calculator to test scenarios.

- Compare 2–3 lenders before committing.

Understanding current mortgage rates puts you in control of your home purchase or refinance. Small steps now can lead to big savings later.

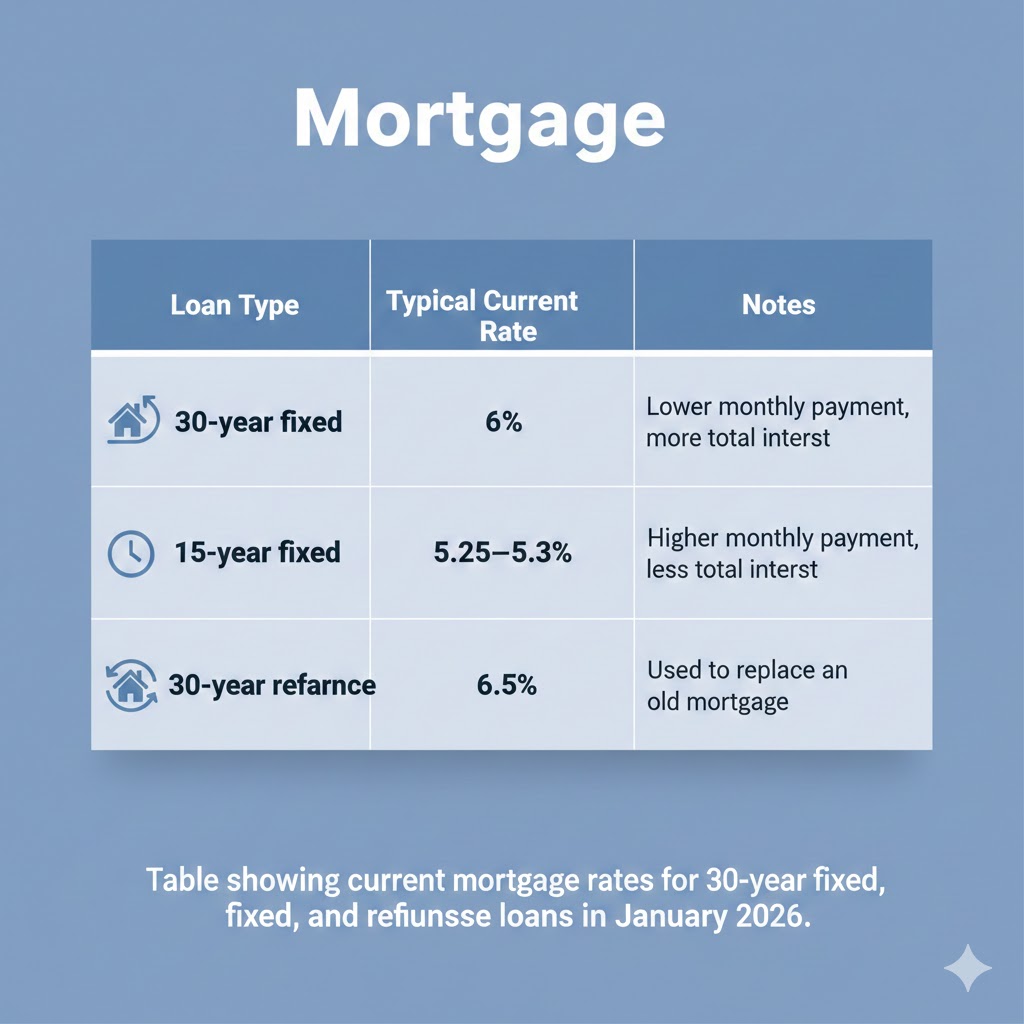

Visual Summary Table:

| Loan Type | Typical Current Rate | Notes |

|---|---|---|

| 30-year fixed | 6% | Lower monthly payment, more total interest |

| 15-year fixed | 5.25–5.3% | Higher monthly payment, less total interest |

| 30-year refinance | 6.5% | Used to replace an old mortgage |

Alt text: “Table showing current mortgage rates for 30-year fixed, 15-year fixed, and refinance loans in January 2026.”