Meta Description (SEO-Optimized):

FHA loans make buying a home easier with low down payments, flexible credit requirements, and beginner-friendly guidelines. Learn how FHA loans work, who qualifies, and whether they’re the right fit for you.

Think You Need a Huge Down Payment? Think Again.

Most people think buying a home requires a mountain of cash. But the truth is, you can get the keys to your own place with as little as 3.5% down using an FHA loan — often less than the price of a used car.

If you’ve been telling yourself, “I’ll never save enough to buy a house,” this guide is about to change your perspective. We’re breaking down FHA loans in simple, real-world language with no confusing bank jargon.

What Is an FHA Loan (In Plain English)?

FHA loans are mortgages insured by the Federal Housing Administration. The FHA doesn’t lend you money — it just guarantees to lenders that if something goes wrong and you can’t make your payments, they’ll cover the loss.

This makes lenders far more willing to approve buyers who:

- Don’t have perfect credit

- Don’t have a large down payment

- Are first-time buyers or anyone who needs more flexible requirements

Think of it like asking to borrow your friend’s expensive camera. If your older brother says, “If anything happens, I’ll pay for it,” your friend suddenly feels much better about loaning it to you.

That’s exactly what the FHA does for borrowers.

Why So Many Buyers Choose FHA Loans

FHA loans create opportunities for buyers who might otherwise be shut out of the market. Here’s why they’re popular:

- Only 3.5% down with a 580+ credit score

- Credit scores as low as 500 can qualify with 10% down

- Flexible approval rules

- You do not have to be a first-time homebuyer

- Lower interest rates compared to many alternative programs

If you want to buy a home sooner, not “someday,” FHA loans can help you get there.

How to Get an FHA Loan: A Simple Step-by-Step Guide

Step 1: Know Your Credit Score

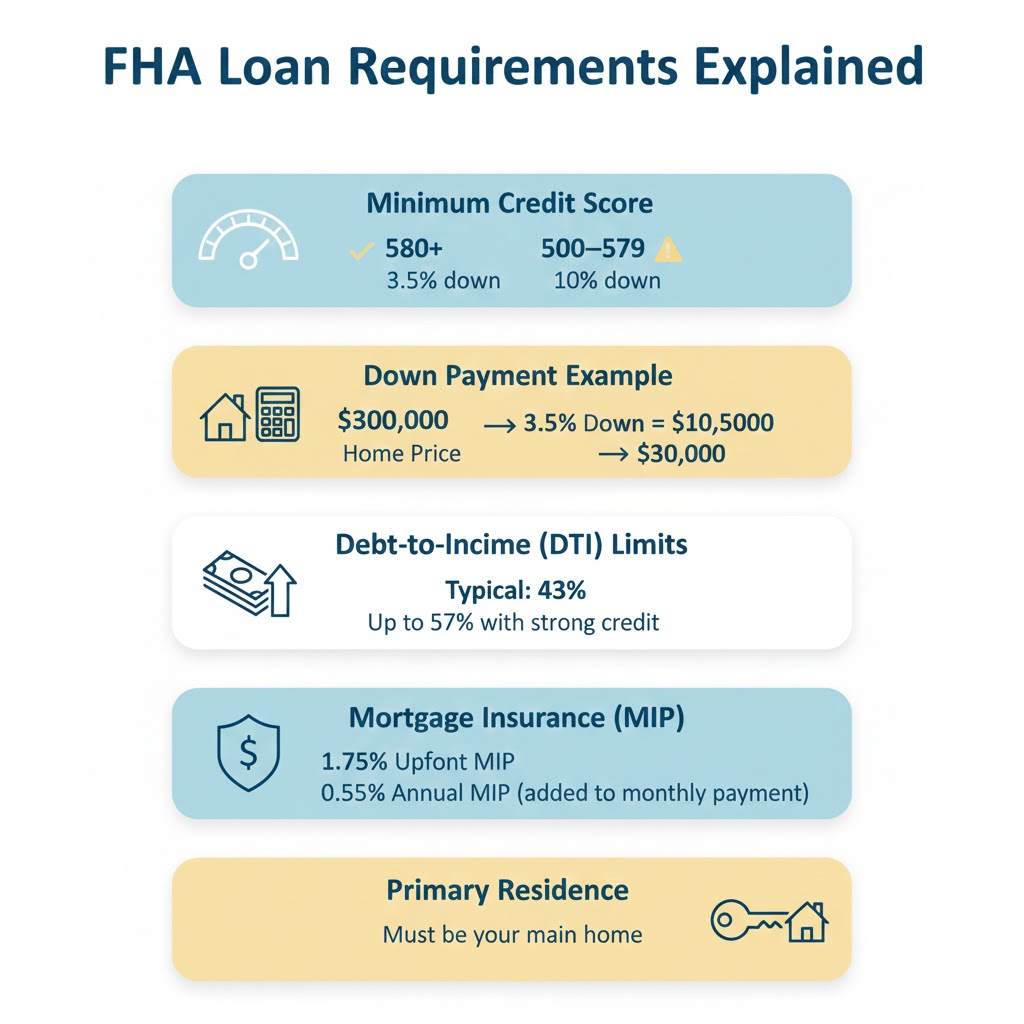

Here’s what FHA guidelines look like:

- 580 or higher: 3.5% down

- 500–579: 10% down

- Below 500: You’ll need to improve your score before applying

Checking your score is quick — apps like Credit Karma or a lender can show you instantly.

Step 2: Save for Your Down Payment

Let’s look at an example with a $300,000 home:

- 580+ score → 3.5% down = $10,500

- 500–579 score → 10% down = $30,000

Compared to the standard 20% down payment of $60,000 on the same home, FHA loans offer massive savings.

FHA also allows:

- Gift funds from family

- Down payment assistance programs

- Grants

- Tax refunds

This makes coming up with the down payment much more achievable.

Step 3: Get Pre-Approved With an FHA-Approved Lender

Not all lenders offer FHA loans, so make sure the one you choose does.

Pre-approval shows sellers you’re serious and gives you a realistic budget.

You’ll need:

- Pay stubs or W-2s

- Bank statements

- Tax returns

- ID

- Employment verification

Most pre-approvals take only a few days.

Important FHA Rules to Understand

1. You’ll Pay Mortgage Insurance (MIP)

Mortgage insurance protects lenders and makes the low down payment possible.

There are two parts:

Upfront MIP

- 1.75% of the loan amount

- Can be rolled into the loan

Annual MIP

- Around 0.55% per year for most borrowers

- Paid monthly

While it adds to your monthly payment, FHA’s lower down payment and flexible credit requirements often still make the loan a great deal.

2. Your Debt-to-Income Ratio (DTI) Matters

Most FHA borrowers can qualify with a DTI up to 43%, and sometimes up to 57% with strong credit.

If you make $5,000 per month, this means your total monthly bills can usually be around $2,150 and still qualify.

3. The Home Must Be Your Primary Residence

FHA loans are designed for owner-occupied homes. You can’t use them for:

- Vacation homes

- Rental properties

- Airbnb investments

The home must also meet FHA safety and livability standards.

How to Maximize Your FHA Loan Benefits

Alternative Ways to Cover Your Down Payment

You’re not limited to saving alone. Explore:

- Down payment assistance programs

- Gift funds from relatives

- Employer homebuyer benefits

- Tax refunds

Many buyers use a combination of these options.

Tips for a Smooth FHA Loan Process

- Start talking to lenders several months before buying

- Avoid new loans or big purchases during the process

- Try not to switch jobs mid-application

- Save extra for closing costs

- Choose a realtor familiar with FHA requirements

Consider FHA Streamline Refinance in the Future

If rates drop later, FHA borrowers can use the Streamline Refinance, which typically requires:

- No appraisal

- Minimal income verification

- Very little paperwork

It’s one of the easiest ways to lower your payment down the road.

A Real-Life FHA Loan Success Story

A family member of mine, Sarah, assumed she’d rent forever. She had:

- A 620 credit score

- Some credit card debt

- About $12,000 saved

With an FHA loan, she bought a $285,000 condo with just under $10,000 down. Two years later, she’s still thrilled with her decision.

Stories like this are exactly why FHA loans were created: to help everyday buyers become homeowners.

Is an FHA Loan Right for You?

Ask yourself:

- Do I have less than 20% saved for a down payment?

- Is my credit score under 680?

- Do I make my payments on time, even if I have some debt?

- Am I buying a home to live in?

If you said “yes” to most of these, an FHA loan may be exactly what you’re looking for.

Quick Stats to Remember

- 3.5% down with 580+ credit

- 10% down with 500–579 credit

- 43–57% debt-to-income limits

- 1.75% upfront MIP

- Approximately 0.55% annual MIP

FHA Loan FAQ (Optimized for Google Featured Snippets)

1. What credit score do I need for an FHA loan?

You need a credit score of 580 or higher to qualify for the minimum 3.5% down payment. Borrowers with scores between 500 and 579 may qualify with 10% down. Scores below 500 do not qualify.

2. How much down payment is required for an FHA loan?

Most FHA borrowers put down 3.5%. If your credit score is 580+, you qualify for this minimum requirement. If your score is 500–579, you’ll need to put down 10%.

3. Does FHA require mortgage insurance?

Yes. FHA loans require:

- 1.75% upfront mortgage insurance premium (MIP)

- Annual MIP, usually around 0.55%, paid monthly

Mortgage insurance allows borrowers to qualify with low down payments and flexible credit.

4. Can I use gift money for an FHA down payment?

Yes. FHA allows gift funds from family members or approved donors to cover your down payment, closing costs, or both. A simple gift letter is required.

5. Can I use an FHA loan to buy a rental or vacation home?

No. FHA loans are for primary residences only. You must live in the home for at least one year after closing.

6. How long does FHA loan approval take?

Most FHA loans close within 30–45 days, although pre-approval can be completed in just a few days.

7. Can I refinance an FHA loan later?

Yes. FHA offers a Streamline Refinance option that lets you refinance with:

- No appraisal

- Minimal documentation

- Faster processing

This is one of the easiest refinance programs available.

8. What is the maximum debt-to-income ratio for FHA loans?

Most borrowers can qualify with a DTI up to 43%, and some may be approved up to 57% with strong compensating factors such as high credit or cash reserves.

9. Do FHA loans have income limits?

No. FHA loans do not have minimum or maximum income limits. Approval is based on affordability, debt levels, and your ability to repay the loan.

10. What types of homes are eligible for FHA loans?

Eligible properties include:

- Single-family homes

- FHA-approved condos

- Manufactured homes (meeting FHA standards)

- Two- to four-unit homes (if you live in one unit)