Imagine you’re 65, sitting in your cozy home you’ve owned for decades, but the bills are stacking up and your retirement income isn’t quite enough. A reverse mortgage could turn your home’s value into cash without forcing you to move or make monthly mortgage payments. Here’s the full guide — explained like we’re chatting over coffee.

What Is a Reverse Mortgage?

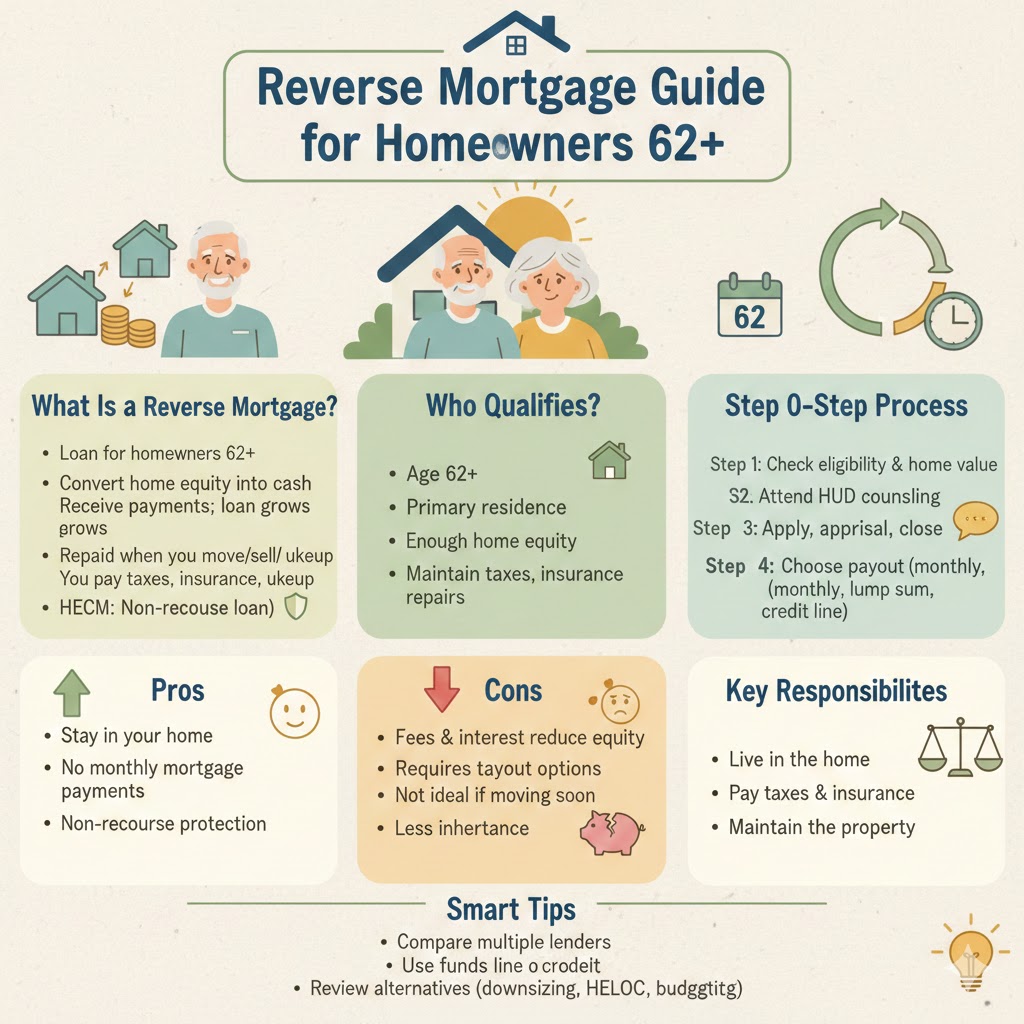

A reverse mortgage is a loan for U.S. homeowners aged 62 or older that lets you borrow against your home equity. Instead of you paying the lender each month, the lender pays you. The loan balance grows over time and becomes due when you sell the home, move out permanently, or pass away.

You still own the home. You must stay current on property taxes, homeowner’s insurance, and maintenance. Failure to meet these obligations can cause the loan to become due.

Most reverse mortgages in the U.S. are Home Equity Conversion Mortgages (HECMs), which include consumer protections and are non-recourse — meaning you or your heirs never owe more than the home’s value.

Why It Matters

Many retirees hold most of their wealth in their homes. A reverse mortgage can improve monthly cash flow without requiring a move. It can help cover medical expenses, home repairs, or general living costs. Because it’s non-recourse, heirs cannot be forced to pay additional money beyond the home’s value.

Step-by-Step: How to Get a Reverse Mortgage

1. Check Eligibility

- You must be 62 or older.

- The home must be your primary residence.

- You must own the home outright or have a low remaining mortgage balance.

- You must continue paying taxes, insurance, and maintenance.

- The amount you can borrow depends on age, home value, and interest rates.

2. Meet with a HUD-Approved Counselor

You must complete a counseling session before applying. A counselor reviews your finances, explains risks and benefits, and helps you compare alternatives.

3. Apply and Close the Loan

Shop multiple lenders. After appraisal and approval, choose how you want the funds: monthly payments, a lump sum, a line of credit, or a combination. You begin receiving funds after closing; no monthly mortgage payments are required as long as obligations are met.

Key Considerations

Reverse mortgages come with costs: origination fees, mortgage insurance premiums, interest, appraisal fees, and closing costs. The loan balance increases over time, reducing home equity. If home values decline, total equity available for heirs may decrease.

You must stay current on taxes, insurance, and upkeep — failing to do so risks foreclosure.

Ask yourself:

- Do I plan to stay in this home long-term?

- Can I reliably pay taxes and insurance?

- Am I comfortable reducing home equity?

- Are there cheaper or simpler alternatives?

How to Maximize a Reverse Mortgage

- Choose a line of credit if you want flexibility and potential growth of unused funds.

- Make optional payments to preserve equity.

- Use funds strategically — supplement income rather than replace it.

- Avoid unnecessary spending or giving away large sums.

- Keep documentation organized and review your plan annually.

Alternatives & Tips

Consider:

- Home equity loans or lines of credit, which require monthly payments but may cost less.

- Downsizing to a more affordable home.

- Using savings, benefits planning, or budgeting strategies before tapping home equity.

Tips:

- Compare at least three lenders.

- Consult a financial advisor or attorney.

- Be cautious of aggressive marketing or offers tied to contractors or investment schemes.

Wrapping Up

A reverse mortgage can be a valuable tool for homeowners 62+ who want to age in place while accessing home equity. It offers flexibility, but also long-term costs and responsibilities. With counseling, careful planning, and smart use, it can help make retirement more comfortable. Always review your long-term goals before deciding.