Introduction: Let’s Talk About That Dream Home

Have you ever thought about buying a house but wondered, “How in the world would I ever afford that?” You’re not alone. Most people don’t have hundreds of thousands of dollars sitting around in their bank account. That’s where something called a mortgage comes in—and it’s actually pretty awesome once you understand how it works.

Buying a home is probably one of the biggest purchases you’ll ever make. It can feel overwhelming and confusing, especially with all the fancy financial talk. But here’s the good news: a mortgage is just a fancy way of saying “I’m going to borrow money from a bank to buy a house, and I promise to pay it back slowly over time.” That’s it! It’s not nearly as complicated as it sounds.

In this article, we’re going to break down everything you need to know about mortgages. We’ll talk about what they are, how they work, the different types, and what to think about before you get one. By the end, you’ll feel way more confident about this whole home-buying thing. Let’s dive in!

What is a Mortgage? The Simple Version

Think of a mortgage like this: imagine you want to buy a video game that costs $500, but you only have $100 right now. Your friend offers to lend you the rest if you promise to pay her back $20 every month. After 22 months, you’ve paid her back completely, and the game is all yours. That’s basically how a mortgage works, except instead of a video game, it’s a house, and instead of your friend, it’s a bank.

A mortgage is a loan that a bank gives you to help you buy a home. When you get a mortgage, the bank is saying, “We’ll give you hundreds of thousands of dollars to buy that house. In return, you promise to pay us back every single month for the next 15, 20, or 30 years, plus some extra money called interest.”

Here’s the important part: the bank isn’t just being nice. They charge you interest, which is basically rent money for borrowing their cash. If you borrow $300,000 from the bank, you’ll end up paying back way more than $300,000 over time because of that interest. The bank makes money, and you get to own a home. Win-win!

Why Does Interest Exist?

Think about it this way: if you lend your friend $100, and they never give you anything back except $100, you didn’t really benefit. Banks think the same way. Interest is like a thank-you payment for letting you borrow their money. The longer you take to pay it back, the more interest you pay. It makes sense, right?

How Do Mortgages Work? Let’s Break It Down

Okay, so you want to buy a house. Here’s the basic flow of how a mortgage gets you from “just dreaming” to “I own a home”:

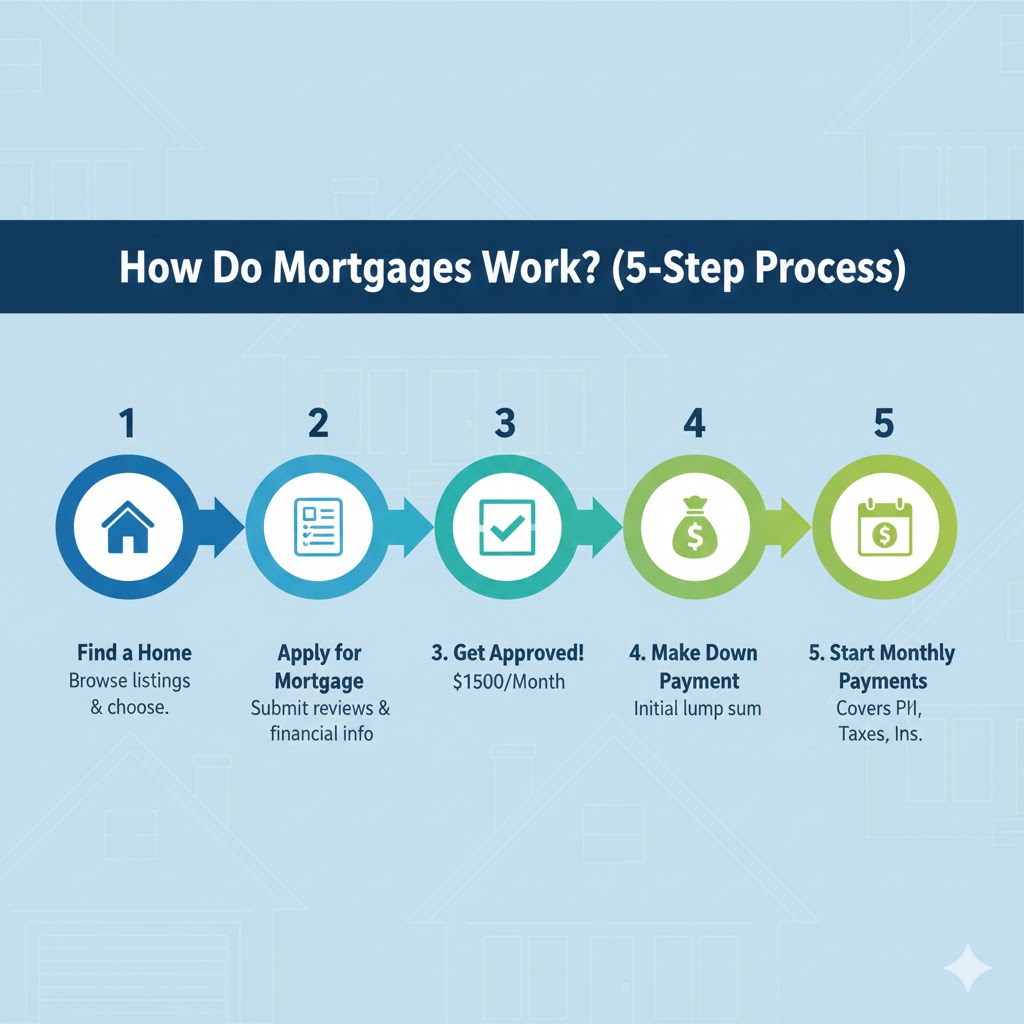

Step 1: You Find a Home You Love

You find that perfect house in the neighborhood you want. Let’s say it costs $350,000. You’ve saved up some money—maybe $70,000—but you need the rest.

Step 2: You Apply for a Mortgage

You go to a bank and say, “Hey, I want to buy this house, but I need to borrow $280,000.” The bank doesn’t just say “sure!” right away. They need to make sure you can actually pay them back. They’ll check your job, your income, your credit score (basically, your history of paying bills), and other stuff. This process is called getting approved.

Step 3: The Lender Approves You

If the bank believes you can pay them back, they approve your loan. They tell you exactly how much you can borrow, what interest rate you’ll pay, and how long you have to pay it back. Congratulations—you’re pre-approved!

Step 4: You Make Your Down Payment

The down payment is the money you put down upfront. In our example, that’s your $70,000. The bank lends you the rest ($280,000), and together, that’s enough to buy the house.

Step 5: You Start Making Monthly Payments

Now comes the part where you actually pay the bank back. Every single month for the next 15, 20, or 30 years (depending on your agreement), you send the bank a payment. This payment includes:

- Principal: Money that actually goes toward paying off what you borrowed

- Interest: Money the bank gets to keep as their profit

- Property taxes: Money that goes to your local government

- Insurance: Money that protects your house in case something bad happens

All of these go into one monthly payment. It’s like a bundle deal!

The Two Main Types of Mortgages: Fixed-Rate vs. Adjustable-Rate

Not all mortgages are created equal. There are different flavors, just like ice cream. The two biggest types are fixed-rate and adjustable-rate mortgages. Let’s talk about both.

Fixed-Rate Mortgages: The Reliable Choice

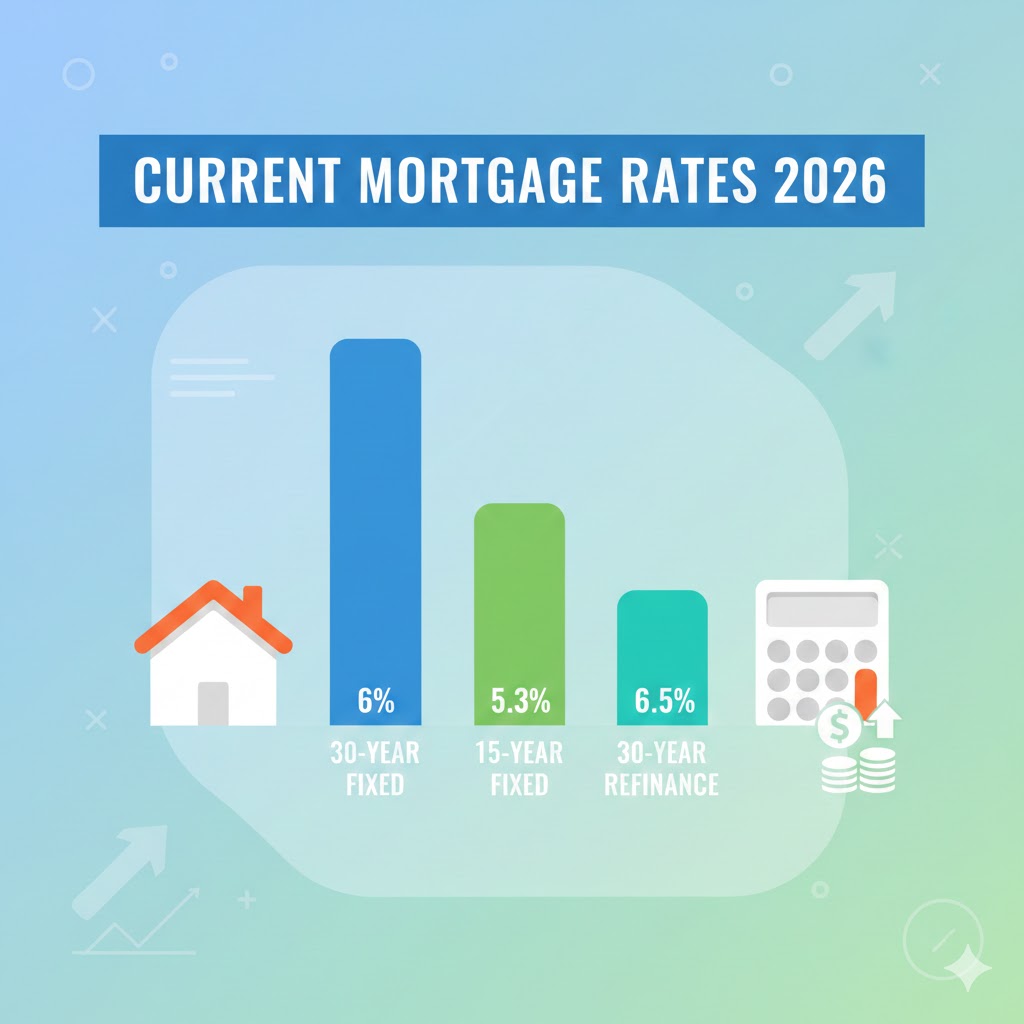

A fixed-rate mortgage is probably the most popular choice, especially for first-time homebuyers. Here’s why: your interest rate stays exactly the same for your entire mortgage. If your rate is 6% today, it’ll be 6% in five years, ten years, and 25 years from now.

This is awesome because it means your monthly payment never changes. You always know exactly how much you’re paying. It’s predictable and easy to budget for. Even if interest rates go up (and they often do), yours stays locked in.

The trade-off: Fixed-rate mortgages usually have slightly higher interest rates than the starting rate of adjustable-rate mortgages. But that’s okay because you get peace of mind and stability.

Perfect for: People who like knowing exactly what they’re paying and who plan to stay in their home for a long time.

Adjustable-Rate Mortgages (ARMs): The Roller Coaster

An adjustable-rate mortgage (often called an ARM) works differently. Your interest rate starts out low—maybe 4%—but it can go up or down as time goes on. Usually, your rate is locked in for the first few years (like 3, 5, or 7 years), and then it adjusts based on market conditions.

Sounds risky? It kind of is, which is why ARMs usually start with lower rates to make them seem attractive.

The trade-off: Your monthly payment could go up (or theoretically down, but that’s rare). If rates spike, your payment could jump significantly, making it harder to budget.

Perfect for: People who plan to sell their house or refinance before the rate adjusts, or people who expect their income to go up.

Your Mortgage Payment: Where Does Your Money Go?

Let’s say your monthly mortgage payment is $1,500. You might think, “Great, I’m paying down my loan by $1,500!” But that’s not quite how it works, especially at the beginning.

That $1,500 typically breaks down like this:

| What It’s Called | Your Payment | What It’s For |

|---|---|---|

| Principal & Interest | $1,100 | $800 goes to interest; $300 goes toward paying off the loan |

| Property Tax | $250 | Local government (for schools, roads, etc.) |

| Homeowners Insurance | $120 | Protects your house |

| Mortgage Insurance (sometimes) | $30 | Extra protection for the bank |

See how only a small chunk actually pays down what you owe? That’s why paying extra on your mortgage early can save you tons of money in the long run. As you pay off your loan, more of each payment goes toward principal and less goes toward interest. It’s like climbing a mountain—the first steps are the hardest!

Key Considerations Before Getting a Mortgage

Before you jump into a mortgage, there are some important things to think about. Let’s go through them.

Do You Have a Down Payment?

Most banks want you to put money down upfront. A common down payment is 20% of the home’s price. So if you’re buying a $300,000 house, you’d need $60,000 saved up. Some programs let you put down less (like 3–5%), but then you might have to pay mortgage insurance, which adds to your monthly payment.

The bottom line: Start saving now. Even a small down payment puts you in a better position.

What’s Your Credit Score?

Your credit score is like a report card for your money habits. Banks use it to decide if you’re trustworthy and what interest rate to give you. A higher credit score means a lower interest rate, which saves you tons of money.

Want a great rate? Aim for a credit score above 700. Anything above 750 is even better. Work on paying bills on time and paying down any debt before you apply for a mortgage.

Can You Afford the Monthly Payment?

Just because a bank will lend you money doesn’t mean you should borrow that much. Make sure the monthly payment fits comfortably in your budget. A good rule of thumb: don’t let your housing payment be more than 28% of your monthly income.

So if you make $4,000 a month, your housing payment shouldn’t be more than about $1,120. This includes your mortgage payment plus property taxes and insurance.

Are You Ready to Stay Put?

Buying a home costs money (closing costs, inspections, appraisals). If you think you might move in a few years, renting might make more sense. Generally, it’s wise to plan on staying for at least 5–7 years to make homeownership worthwhile.

Do You Have an Emergency Fund?

Owning a home means surprise repairs (roof leaks, furnace breaks, etc.). Before you buy, make sure you have some emergency savings set aside. Most experts suggest having 3–6 months of expenses saved up.

Taking It to the Next Level: Smart Mortgage Strategies

Once you understand the basics, there are some clever things you can do to make your mortgage work better for you.

Strategy 1: Make Extra Payments on Your Principal

If you can afford it, send extra money to the bank specifically for your principal. Even an extra $100 per month can save you thousands in interest and help you pay off your house years earlier.

Here’s an example: On a $300,000 mortgage at 6% interest over 30 years, an extra $100 per month could save you over $60,000 in interest and get you debt-free 4 years earlier. That’s huge!

Strategy 2: Refinancing Your Mortgage

Refinancing means getting a new mortgage to replace your old one. You might do this if interest rates drop and you want a lower rate, or if you want to change your loan from 30 years to 15 years.

It’s like trading in your old car loan for a better one. Just remember: refinancing costs money upfront (closing costs), so make sure the savings are worth it.

Strategy 3: Shorten Your Loan Term

Instead of a 30-year mortgage, consider a 15-year mortgage. Yes, your monthly payment goes up, but you pay way less interest overall, and you own your home much faster.

Example: A $300,000 loan at 6% interest

- 30-year mortgage: Monthly payment = $1,799; Total interest paid = $347,515

- 15-year mortgage: Monthly payment = $2,331; Total interest paid = $119,160

That’s over $228,000 in savings! The longer you wait, the more interest you pay.

Common Questions First-Time Homebuyers Ask

“What’s a Mortgage Calculator?”

A mortgage calculator is an online tool that helps you figure out what your monthly payment would be. You plug in the loan amount, interest rate, and how many years you want to pay it back, and boom—it tells you your payment. It’s super helpful when you’re trying to figure out if you can afford a home.

“What’s a Pre-Approval?”

Getting pre-approved means a bank has checked your finances and said, “Yep, we’ll lend you up to $X amount.” It doesn’t mean you’re approved for a specific house yet, but it gives you a clear budget when you’re house hunting. It’s the first big step in the mortgage process.

“What Happens if I Can’t Pay My Mortgage?”

If you stop paying your mortgage, the bank can take back the house through something called foreclosure. This is bad news—it ruins your credit and you lose your home. So make sure you can truly afford your monthly payments before you buy.

“What’s the Difference Between a Loan and a Mortgage?”

A loan is general term for borrowing money. A mortgage is a specific type of loan where your home is the collateral. Basically, all mortgages are loans, but not all loans are mortgages.

Wrapping Up: Your Mortgage Journey Starts Here

Okay, let’s recap what we’ve covered. A mortgage is a loan from a bank that helps you buy a home. You pay back the loan over time—usually 15, 20, or 30 years—with monthly payments that include principal, interest, property taxes, and insurance. There are different types of mortgages (like fixed-rate and adjustable-rate), and choosing the right one matters.

Before you get a mortgage, make sure you have a down payment saved, your credit score is good, your monthly payment fits your budget, and you’re ready to stay in your home for a while. Once you have your mortgage, you can be smart about it by making extra payments, considering refinancing when rates are low, or even shortening your loan term.

Buying a home is one of the biggest decisions you’ll make, but it doesn’t have to be scary. With a solid understanding of mortgages, you’re already halfway there!

Here’s my final thought for you: Do your homework, ask questions, and don’t rush into anything you don’t understand. Talk to multiple lenders, use mortgage calculators to play around with different numbers, and make sure homeownership fits your life and finances right now. You’ve got this!

Have you started thinking about buying a home? What’s holding you back—is it saving for a down payment, not understanding the process, or something else? Whatever it is, now you know that mortgages aren’t as mysterious as they seem. You’ve got the knowledge. Now go make that dream home a reality!

Suggested Visuals to Add

Infographic Ideas:

- “How Your Monthly Payment Breaks Down” (pie chart showing principal, interest, taxes, insurance)

- “Fixed vs. Adjustable Rate Mortgage” (comparison chart showing payment stability)

- “5-Step Mortgage Process” (flowchart from house hunting to homeownership)

Tables:

- Mortgage terms comparison (15-year vs. 20-year vs. 30-year)

- Down payment requirements at a glance

- Interest rate impact on total cost

Calculator Tools:

- Interactive mortgage calculator

- Affordability calculator (“Can you afford this home?”)

Keywords Used

✓ What is a mortgage

✓ Mortgage

✓ Fixed-rate mortgage

✓ Adjustable-rate mortgage (ARM)

✓ Mortgage payment

✓ Mortgage calculator

✓ First-time homebuyer

✓ Down payment

✓ Refinancing

✓ Credit score

✓ Principal and interest

✓ Home loan